portability estate tax exemption

Portability is available only if it is affirmatively elected on a timely filed federal estate tax return. Since then the value of the estate tax exemption has grown each year.

Tax Related Estate Planning Lee Kiefer Park

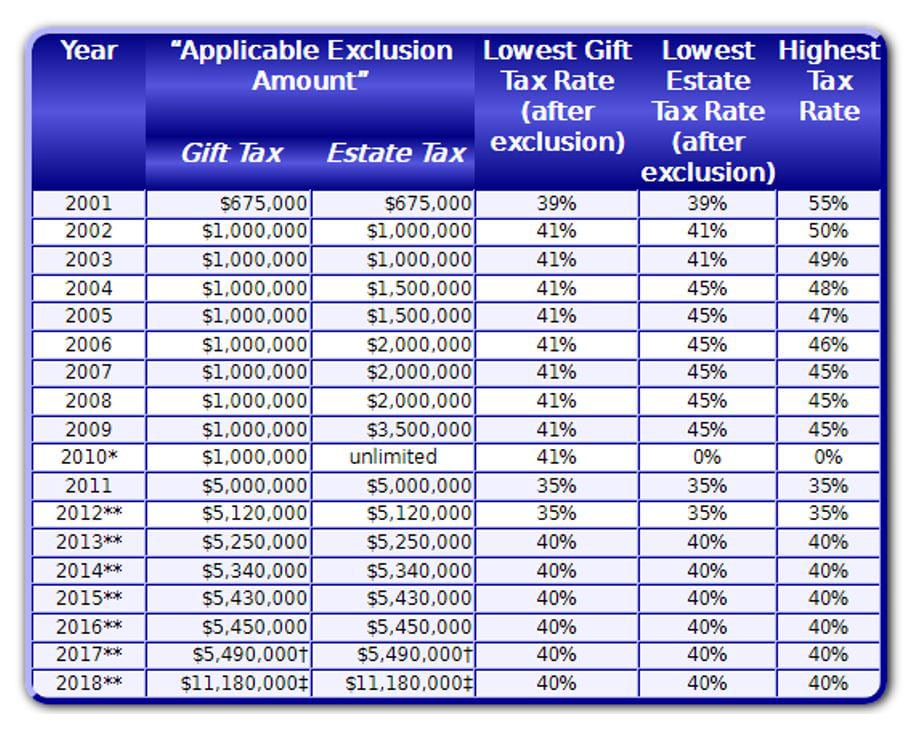

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the surviving.

. When enacted it was meant to apply only to. Portability of the estate tax exemption The American Tax Relief Act of 2012 ATRA signed into law on January 3 2013 by President Obama extended the opportunities for portability of a decedents unused estate tax exemption. In 2010 it increased to 1158 million.

This exemption stayed in place for ten years when the amount increased to 100000 before bottoming out at 40000. The portability feature means that when one spouse dies and his or her estate value does not use up to the total available estate tax exemption the unused portion of the estate tax exemption is then added to the available estate tax exemption for the. Floridas Save Our Homes SOH provision allows you to transfer all or a significant portion of your tax benefit up to 500000 from a Florida home with a homestead exemption to a new home within the state of Florida that qualifies for a homestead exemption.

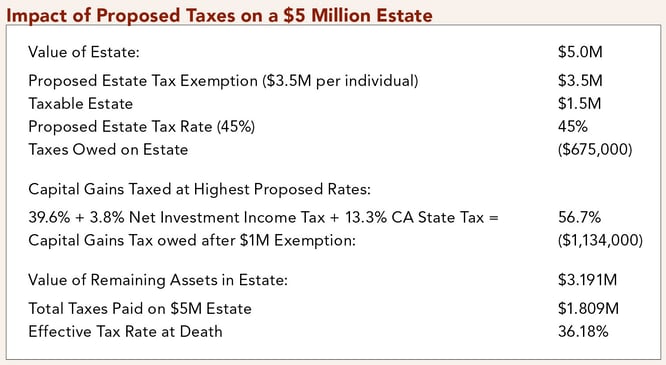

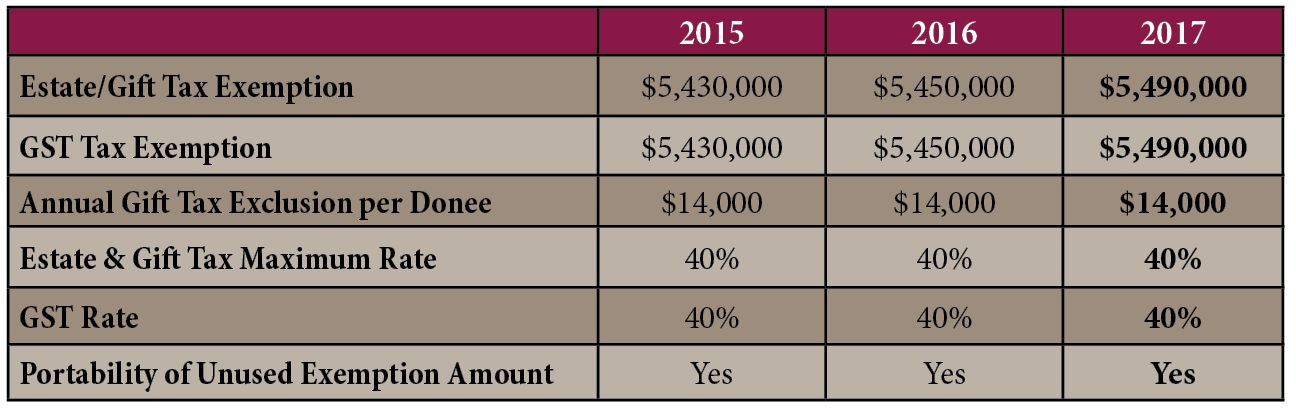

The American Taxpayer Relief Act of 2012 ATRA made permanent the portability of estate tax exemption between spouses. As of 2021 the federal estate tax exemption is 114 million. The TCJA doubled the estate and gift tax lifetime exemption from 549 million per taxpayer to 1118 million per taxpayer.

In effect portability increases the 2nd to dies. E file for Portability when E filing for your Homestead Exemption click here. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely.

Estate and gift taxes are affected by the principles of portability and they are a part of a group of taxes known as federal transfer taxes. There are three distinct but related federal transfer taxes. Under portability if the first spouse to die does not use his or her exemption from estate and gift tax the executor of the first spouses estate may elect to give the use of the remaining exemption amount to the surviving.

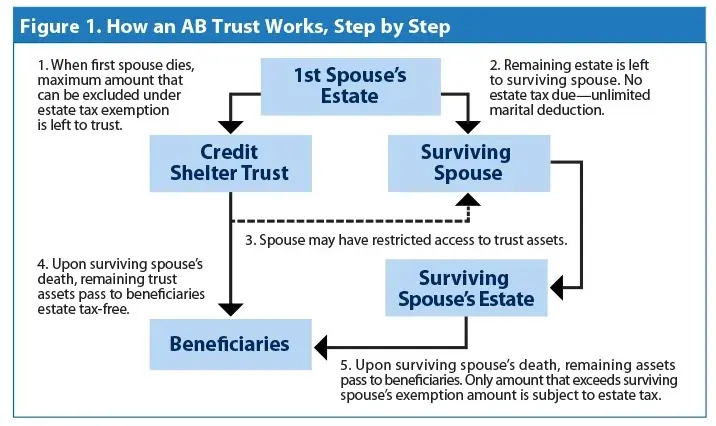

The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way. Portability in Estate Tax Exemptions. How does the Federal Estate Tax Exemption work.

That gives the couple a total exemption of more than. Why You May Want to Transfer Your Unused Estate Tax Exemption to Your Spouse December 17 2019 by Cathy Lorenz. Secondly it only applies to the federal estate tax exemption.

Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life andor estate tax at the surviving spouses death. A surviving spouse can get a big federal estate tax break if the deceased spouse didnt use up his or her individual estate tax exemption. However by applying for portability of the first to dies unused exemption when heshe passes away the surviving spouse can use the 9580000 unused exemption amount plus their 11580000 exemption amount to make the 568000 tax go away.

The option of portability can make a significant difference when it comes to taxation of an estate. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. Available only for federal estate tax purposes portability was made permanent by the American Taxpayer Relief Act of 2012 allowing an estate of a predeceased spouse to pass its unused federal exclusion to the surviving spouse.

Hawaii and Maryland are two of the few states that allow portability of their state estate tax exemption. There is not as much need to split the exclusions and have the estate of the first spouse to pass away get allocated into a credit shelter trust or bypass trust. On top of this generous amount the IRS also allows for portability of the exemption between.

The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000. The surviving spouse can use the unused portion of the predeceased spouses estate and gift tax exemption. Two important aspects to remember are that the portability exemption is only available to married couples and only applies to Federal estate taxes.

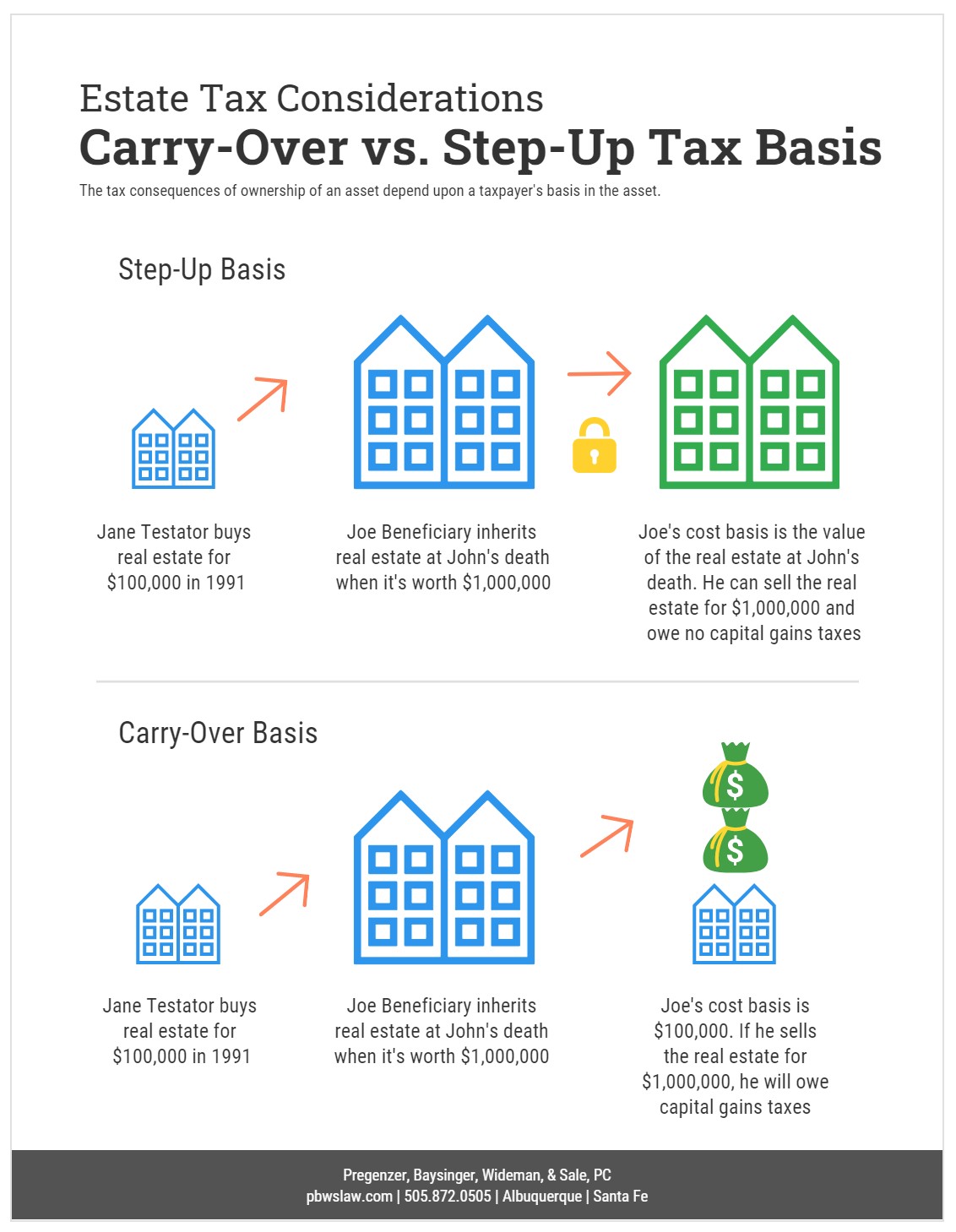

1 Congress repealed the estate tax for 2010 but then gave taxpayers the option to opt in to the estate tax regime with steppe-up basis or opt out and. For 2019 the exemption sat at 114 million. Portability essentially allows two spouses to combine their estate exclusions together into one large exemption.

There are only two states Hawaii and Maryland that have provisions for state estate tax portability as of 2020. The Tax Relief Unemployment Insurance Reauthorization and Job Creations Act of 2010 introduced for the first time the concept of portability of the federal estate tax exclusion between spouses. While most states dont have an estate tax some do.

Theres another important exemption from generation skipping transfer tax or GST tax and that is an exemption that allows transfers to grandchildren and further descendants without that additional GST tax or gift and estate tax. All of these taxes impact the amount of money passed to an individuals. The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so.

For 2019 the exemption has been adjusted for inflation to 114 million per taxpayer and 228 million per married couple. You will want to be aware that portability may not be the right decision for your situation if for example you choose to divide. This is referred to as portability.

Estate tax gift tax and generation-skipping transfer GST tax. Thanks to the portability rule the survivor can use whats left. The tax for the estate would be 568000 at a 40 tax rate.

Each year the federal estate tax increases as it is indexed for inflation. Lastly one important limitation on portability is that it only applies to the estate and gift tax exemption. Portability is a federal exemption.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Is Ab Trust Planning Still Effective

Exploring The Estate Tax Part 2 Journal Of Accountancy

El Antes Y Ahora De Los Juegos Nostalgia

Filing For Homestead Exemption In Florida Florida Homesteading Real Estate Information

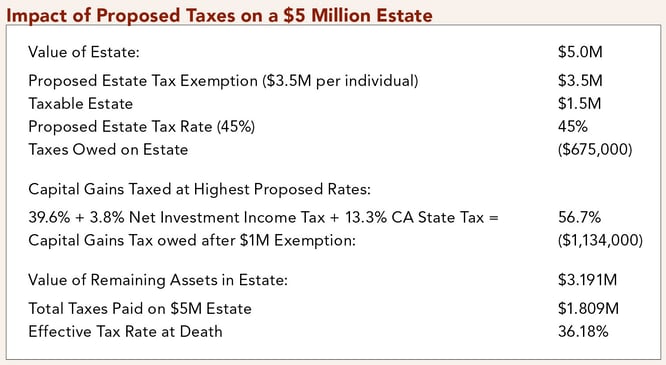

Estate Taxes Under Biden Administration May See Changes

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Gsa Ser Verified Lists Daily Updated Verified Site Link Lists For Gsa Search Engine Ranker Xrumer Scrapebox Ultimate Places To Visit Places To Go Majorca

Understanding Qualified Domestic Trusts And Portability

This First Installment Of A Two Part Article On Everything Practitioners Should Know About The Estate Tax Includes The Unified Estate T Estate Tax Home Estates

Adler Adler Portability Of Estate Tax Exemption

Federal Estate Tax Portability The Pollock Firm Llc

Estate Tax Introduction Video Taxes Khan Academy

A New Era In Death And Estate Taxes

A Trust May Be Taxed As Either A Grantor Trust Or A Nongrantor Trust Each Type Of Trust Has Advantages And Disadvanta Estate Tax Estate Planning Grantor Trust

The 2017 Estate Tax Exemption The Ashmore Law Firm P C

Portability In Estate Tax Law Special Needs And The Law

Pin By Debbie Wolfe On Trusts Revocable Trust Living Trust Estate Tax

Taxation And Initial Coin Offerings Time And Time Again I Talk To Companies That Are In The Middle Of An Ico And The Way The Initials Coins Columbia Maryland